TALK KOK.

Short Selling: The Hoo-hah

2 Comments Published by wengkeong on Friday, September 19, 2008 at 22:57.

With all the big hoo-hah on short selling now I thought I'd give a little digestible entry on why its such a big deal on Wall Street and what's actually going on. (Read the unfun New York Times entry here or read what's below! Smile!)

In a time when stocks plummet and business sucks, it is only ordinary that individuals find some way to make some cash out of the situation. And here comes the scenario of short selling. Media has told us that in short selling, investors want stock prices to go down, and not up- which is diametrically opposed to traditional investment (when investors want share prices to go up). So how does this really work? And why is the New York Attorney-General trying to ban it?

Let's start with the profiteering stock buyers.

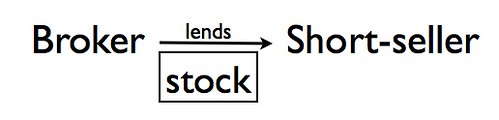

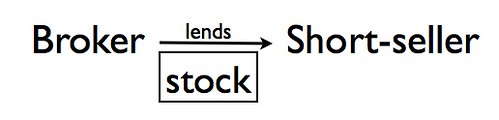

Short sellers will first attempt to borrow stocks from Brokers (someone who buys and sell stuff for couch investors). They are now in a "stock debt" and owe the brokers the stocks they borrowed.

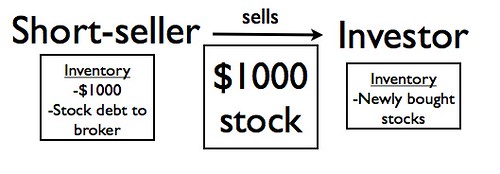

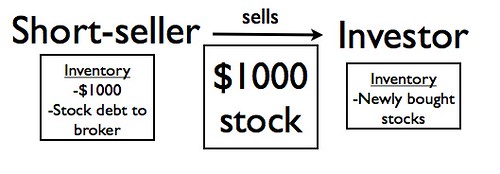

Let's say that now the total cost of the stocks borrowed are valued at $1000 in the open market. The short seller then sells the stock to any investor bidding in the crazy place where everyone is shouting.

The short-seller now has $1000 and an existing stock debt. He cannot clear his debt with the thousand dollars because his work would have come to naught.

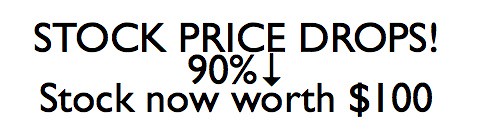

For some reason the stock price drastically drops! (Earthquake/SARS/terrorist attacks/whatever)

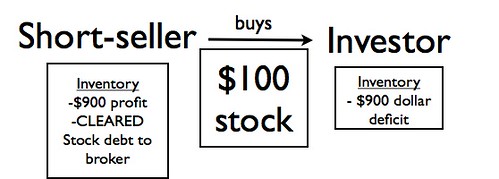

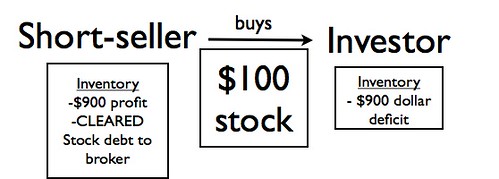

The short seller now quickly buys up these cheap stocks and then returning them to the Broker he borrowed them from. He now makes a profit!

Note to all: I have never studied Economics in my life (although I hope to next year) and have almost zero foundational knowledge in this subject. In any case should you wish to correct anything you view wrong in the above entry, please feel free to do so in the comments section.

In my opinion this is a rather nifty way of earning some bucks and takes some real risk, adrenaline and brains to actually execute it. But the current legal dispute about it now is that short sellers, in order to ensure maximum profit, are spreading rumors about the market in order to ensure stock prices fall. This is creating an extremely distrustful, investor unconfident market sending Wall Street into further turmoil.

What do you think?

In a time when stocks plummet and business sucks, it is only ordinary that individuals find some way to make some cash out of the situation. And here comes the scenario of short selling. Media has told us that in short selling, investors want stock prices to go down, and not up- which is diametrically opposed to traditional investment (when investors want share prices to go up). So how does this really work? And why is the New York Attorney-General trying to ban it?

Let's start with the profiteering stock buyers.

Short sellers will first attempt to borrow stocks from Brokers (someone who buys and sell stuff for couch investors). They are now in a "stock debt" and owe the brokers the stocks they borrowed.

Let's say that now the total cost of the stocks borrowed are valued at $1000 in the open market. The short seller then sells the stock to any investor bidding in the crazy place where everyone is shouting.

The short-seller now has $1000 and an existing stock debt. He cannot clear his debt with the thousand dollars because his work would have come to naught.

For some reason the stock price drastically drops! (Earthquake/SARS/terrorist attacks/whatever)

The short seller now quickly buys up these cheap stocks and then returning them to the Broker he borrowed them from. He now makes a profit!

Note to all: I have never studied Economics in my life (although I hope to next year) and have almost zero foundational knowledge in this subject. In any case should you wish to correct anything you view wrong in the above entry, please feel free to do so in the comments section.

In my opinion this is a rather nifty way of earning some bucks and takes some real risk, adrenaline and brains to actually execute it. But the current legal dispute about it now is that short sellers, in order to ensure maximum profit, are spreading rumors about the market in order to ensure stock prices fall. This is creating an extremely distrustful, investor unconfident market sending Wall Street into further turmoil.

What do you think?

2 Responses to “Short Selling: The Hoo-hah”

Post a Comment

Opinari

Ha, that's a comprehensive summary. But it's only the tip of the iceberg. I think I shall go read teh NY times' entry.

Its not just economics, its politics as well.